Supply Chain Finance 2.0: Why Financial Innovation is the Missing Link in Supply Chain Resilience

While companies have poured investment into physical supply chain improvements (tracking, automation, sourcing diversification), many ignore financial

While companies have poured investment into physical supply chain improvements (tracking, automation, sourcing diversification), many ignore financial

Working capital is an integral part of trade finance. The flow of capital worldwide partly depends on

London, England, UK, June 12, 2025 ⏤ LiquidX was delighted to attend and be a silver sponsor

Miami, Florida, 4 ⏤ 6 June, 2025 ⏤ LiquidX was delighted to attend and be a gold

Compliance has long been perceived as a necessary friction in trade finance — an operational bottleneck that

Washington DC, May 4 ⏤ 7, 2025 ⏤ LiquidX was delighted to attend and be a gold

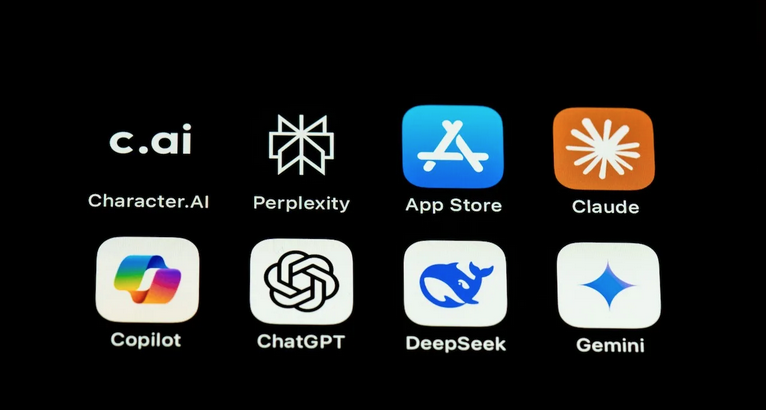

Generative AI is already slowly starting to transform trade finance, and in particular, trade finance risk management.

LiquidX’s Trade Finance Distribution software is a complete front office trade finance solution to originate and distribute

Trade finance distribution is a way of unlocking liquidity from trade finance products. Originators are usually banks,

Monetizing working capital should unlock new revenue opportunities, whether you’re a bank, asset manager, or corporate. The

Trade finance digitization turns trade finance assets like invoices and order books into smart contracts that give

Trade finance is relatively low-risk, self-collateralized, and generates healthy returns in a short timescale. For those reasons,

© 2025 LIQUIDX. All rights reserved.