Banks, particularly regional and smaller commercial banks, are one of the main sources of trade finance capital. Trade finance is also an important revenue stream for small and medium-sized banks, both in America and around the world.

Like any lending product, smaller and regional banks focus on SMEs. As Trade Finance Global (TFG) notes: “The specific trade finance services that banks offer will vary, but will usually include services such as issuing bills of exchange or letters of credit and accepting drafts and negotiating notes.”

As TFG also notes: “Banks are a popular source of trade finance because their cost of borrowing is often lower than most alternative lenders.

However, a bank is usually under heightened regulatory pressure, so there are longer decision timeframes and less flexibility.”

As banks with trade finance programs know, there are a lot of avenues you can pursue:

- Supply Chain Finance

- Invoice Discounting

- Payables Finance

- Accounts Receivable

- Invoice Factoring

- Pre- and Post-Shipment Financing

- Distributor Financing

- Reverse Factoring

Any party can act as an originator, distributor, buyer, or seller. In most cases, the originator is a financial provider, such as a bank, an asset management firm, or a corporate treasury.

That’s one of the things that makes trade finance distribution so attractive: the market’s fluidity.

Why Trade Finance is Attractive to Regional Banks

As we’ve covered in other articles, the trade finance market and subsequent distribution market are huge.

Trade finance is a fast-growing market. 80 to 90% of world trade relies on trade finance, which is currently worth $9.7 trillion, with a CAGR of 3.1%.

Trade finance distribution is the most effective way to monetize this multi-trillion-dollar market.

One growth area is supply trade finance. SCF grew at a CAGR of 26% from 2017 to 2023, despite rising global protectionism and tariffs.

SCF continues to grow at a rate of “7% annually, currently worth $2.34 trillion, with funds in use at $916 billion,” according to the latest BCR Publishing’s World Supply Chain Report 2024. (2023 figures).

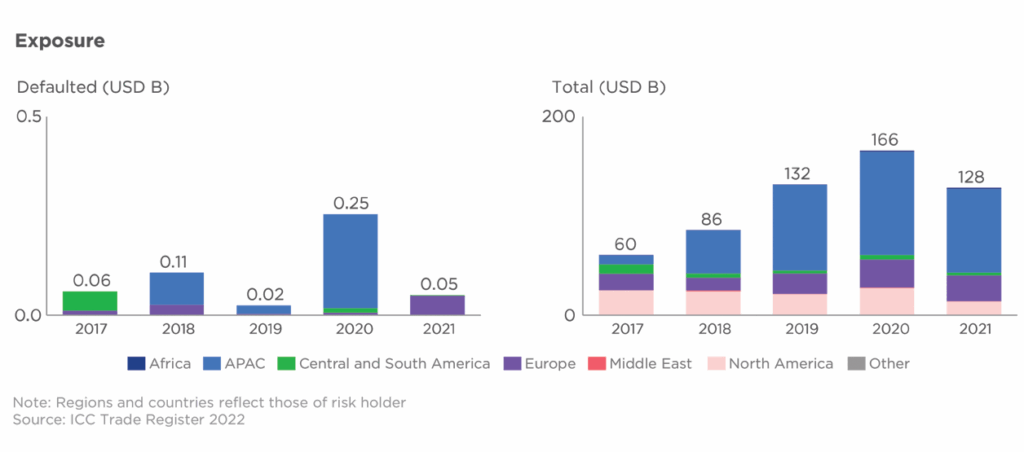

Alongside high growth rates, trade finance is very low-risk. Making this a more attractive opportunity in turbulent times. In most cases, default rates are in the 0.25% to 0.5% range. *

Table 1: The default rates of trade finance distribution have always been low

Low-risk and very low default rates for accounts receivable (AR) and supply chain finance (SCF) (source)

Now, the good news for regional and smaller commercial banks is that you:

- Know your customers, understand their business and financial needs better than larger banks.

- Aren’t restricted by Basel III adoption: the more stringent financial capital requirements fall more heavily on the world’s largest 37 banks (Tier 1 banks), with over $100 billion on their balance sheets.

- Can ramp-up trade finance programs more easily when the right opportunities are available.

- Don’t need to increase headcount to scale trade finance programs when you work with the right partner, like LiquidX: We can handle everything for you.

Speaking at a TTP rooftop event in New York that we hosted in the Summer, Cory Speece, Managing Director for Supply Chain Finance and Global Trade at Huntington National Bank, said:

“When you consider the types of programmes that regional banks of our size and smaller had been working on before the advent and infusion of technology like LiquidX’s, we were relegated to really small programmes with one seller, maybe one account debtor, a handful of invoices.”

How LiquidX Can Support Regional Banks Getting into Trade Finance

Don’t worry about onboarding timescales or whether you need to increase your headcount for a trade finance program. With LiquidX, we can handle an entire, end-to-end trade finance program for regional and commercial banks.

Our software is also ideal for regional banks who want to monitor trade finance investments within their larger portfolio. This way, you can track invoices and data involved in funding this asset class and when to expect a return on the capital invested.

Here’s what you can benefit from when you partner with LiquidX:

- Trade finance software that can take in any invoice format (e.g., XLSX, PDF, etc.), and use that as workable data downstream across the trade lifecycle.

- Trade: Automatically digitizes assets in the front office.

- TradeHub: Manages portfolio risk with ease.

- TradeOps: Make significant back office savings; up to 50% savings compared to in-house back office software.

- InMatch: Can handle reconciliation challenges for asset managers.

- Includes the advantages of a deep partnership with Broadridge (NYSE: BR), a trusted global fintech leader. Broadridge is LiquidX’s largest committed investor and strategic operational services provider for payment processing, account reconciliation, and global operational scalability.

Our software handles tens of billions of dollars worth of transactions every year, and we’re working with some of the world’s largest banks, and dozens of regional and commercial lenders.

The Need for Off-Balance Sheet Profit-Drivers

The 2025 ICC’s Trade Register report confirms what we have been saying: Basel 3.1 is fundamentally changing the economics of trade finance.

When on-balance sheet products become capital-intensive, banks face a critical choice: either significantly increase pricing or find more efficient ways to manage risk and capital.

For LiquidX, this isn’t just a challenge — it’s an opportunity. Our platform provides the strategic necessity the ICC highlights: a mechanism for banks to offload trade assets efficiently, manage their capital exposure, and maintain client relationships without prohibitive pricing.

The future of trade finance is about intelligent distribution and liquidity. We’re here to help banks make that transition seamlessly.

Here’s another great reason to work with us! In 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade, United States 2025

- Best Technology Vendor Of The Year, United States 2025

- Best Fintech For Trade, United States 2025

Banks: Get a demo of our trade finance solutions. Find out why 100+ financial sector firms trust us to deliver multi-billion dollar trade finance programs.