Compliance has long been perceived as a necessary friction in trade finance — an operational bottleneck that slows transactions, adds cost, and introduces complexity.

There’s no getting around Know Your Customer (KYC) and Anti-Money Laundering (AML) workflow tasks. In almost every area of financial services, these are a legal necessity, and trade finance in all its forms requires compliance.

However, the view that this is simply an operational bottleneck is rapidly changing. As digital transformation and AI continue to reshape global trade, forward-looking banks, asset managers, and corporates are beginning to embed regulatory requirements directly into trade finance workflows. The result?

A shift from reactive compliance to proactive operational resilience — and even competitive advantage.

Why Is Regulatory Compliance Mission-Critical in Trade Finance?

Trade finance sits at the intersection of global commerce, finance, and regulation. Trade finance covers a wide range of financial products, and multiple parties can be involved in any one or series of transactions, including the following:

- Supply Chain Finance (SCF)

- Accounts Receivable (AR)

- Invoice Factoring (IF)

- Pre- and Post-Shipment Financing

- Distributor Financing

- Reverse Factoring

There are also numerous players in this vast interconnected market:

- Asset managers

- Corporates

- Banks

- Insurers

- Importers and Exporters

- Shipping Companies

- Non-bank, Trade Finance Providers

- FinTech SaaS Providers

- Export credit agencies and third-party service providers

Any party can act as an originator for a distribution deal, although it’s usually a financial provider, like a bank, asset management firm, or corporate treasury.

Any party can also act as a buyer, or intermediary, depending on the deal terms. Distribution products can be anything from short-term, relatively small bundles of finance, like $1M over 90 days, or much larger and longer-term assets.

Trade finance, in all its forms, is uniquely exposed to a host of compliance risks — from sanctions violations and AML breaches to environmental, social, and governance (ESG) disclosures and cross-border regulatory reporting obligations.

As we’ve covered in previous articles, one of the advantages of trade finance is the low-risk nature of these financial instruments, which makes them attractive opportunities for banks and asset managers.

However, this sector is not immune to fraud, corruption, and risks like money laundering. According to EY, “An estimated $1 trillion of financial crime proceeds flow through the $9.1 trillion industry’s trade channels each year.”

As a result, KYC and AML are an essential part of any trade finance transaction. Regulatory compliance can be an expensive ⏤ but operationally crucial ⏤ part of trade finance.

An EY article notes that: “On average, a large trade finance bank can spend anywhere from $25m to $42m annually on risk, compliance, sanctions and anti-money laundering (AML) tasks – all without growing its business.”

One of the reasons for this is that trade finance is still stuck in manual and outdated ways of working.

Paper invoices. Excel spreadsheets. Even faxes.

Moving banks, asset managers, and corporates away from these manual (and more liable to regulatory failings) processes and into digital ones would save a lot of money and make trade finance transactions more secure.

For financial institutions and corporates alike, compliance is not just a back-office function — it’s mission-critical to maintaining market access, partner trust, and operational continuity.

What Is the True Cost of Compliance Errors?

Non-compliance is expensive. In recent years, banks and financial institutions have paid billions in fines for failures in AML, sanctions screening, and KYC processes.

Regulators tend to have more teeth in cities and countries where we see the most financial activity, because a higher volume of transactions attracts more criminals, fraud, and these days, AI-based attacks. In recent weeks, several prominent UK retailers have suffered crippling cyberattacks through third-party vendors, with phishing and AI believed to be part of how cybercriminals gained access.

No business is immune to these types of attacks, and the trade finance sector is especially vulnerable, with “$1 trillion of financial crime proceeds” flowing through trade finance channels every year.

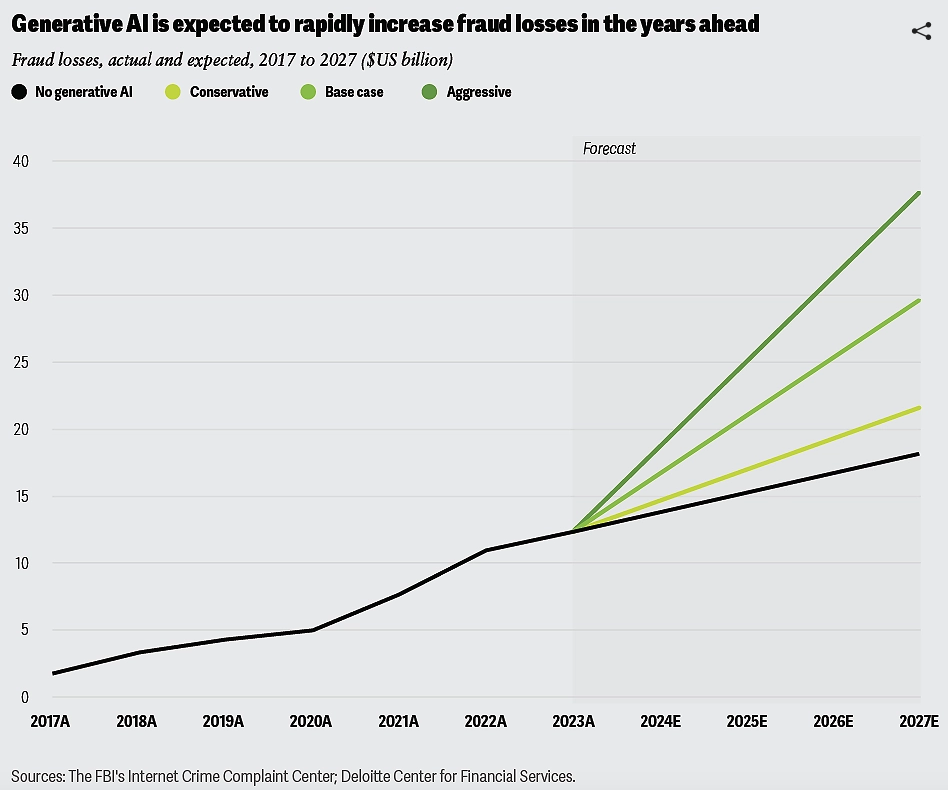

Despite the relative newness of AI attacks, like deepfakes, they’ve already cost businesses and consumers “$12.3 billion” in losses, as of 2023, with a “compound annual growth rate of 32%”, FBI and Deloitte data projects that “Gen AI could enable fraud losses to reach$40 billion in the United States by 2027.”

The cost of Generative AI is the most high-growth cyberattack avenue against banks and the financial services sector

FBI and Deloitte data.

One consequence of errors and successful cyberattacks is regulatory fines, and since The Great Recession (2007-09), regulators have been quick to hand out punitive penalties for anything that breaches AML, sanctions screening, and KYC processes.

According to KPMG: “In the US, where regulators are among the world’s most aggressive in imposing fines and sanctions, banks have been hit with nearly US$24 billion in non-compliance fines since 2008.”

Hence why banks and other financial organizations need big budgets for regulatory compliance software and other tools. According to KPMG: “In the US alone, banks are spending more than US$25 billion a year on AML compliance.”

But the true cost goes beyond regulatory penalties.

Manual compliance checks delay transaction processing and frustrate clients. Disjointed systems and duplicated efforts waste time and resources. As KPMG notes: “AML and KYC processes also lead to lower productivity (due to significant re-work requirements), greater government scrutiny (in cases where problems persist) and the potential for decreased customer satisfaction.”

Poor compliance integration can lead to lost deals, strained correspondent banking relationships, and missed opportunities in emerging markets.

On the other hand, firms that embed compliance into their trade finance digital infrastructure reduce risk, increase speed, and gain a reputational edge that clients and partners recognize and favor, making them the preferred choice for deals compared to financial institutions that are still behind the digital compliance curve.

Now, let’s look at ways we can embed more streamlined yet equally effective regulation across trade finance workflows and transactions.

How Can We Embed Regulation in Trade Finance Workflows?

The key lies in modular trade finance platforms and software tools that can seamlessly integrate compliance checks into daily operations.

Here are 4 ways that regulatory compliance can be embedded more easily across trade finance workflows and transactions.

- Smart document validation: AI-powered tools can verify trade documents (invoices, insurance, letters of credit (LoC), bills of lading, etc.) against compliance rules in real time, flagging discrepancies before they escalate into regulatory issues.

Trade finance often involves processing invoices, certificates of origin, and customs documents. AI-driven optical character recognition (OCR) and natural language processing (NLP) accelerate document review and extraction, dramatically reducing turnaround times.

All of this makes digitization, which is the first stage in any trade finance transaction, including monetization.

- AI-based risk management

AI systems assess geopolitical events, commodity price shifts, and supply chain disruptions in real time. When this data is integrated with client credit profiles and transaction history, trade finance teams can proactively manage counterparty and operational risks.

- Advanced fraud detection

Like any financial sector, trade finance is susceptible to fraud like duplicate financing, document tampering, and false invoicing.

AI-powered systems can be deployed to detect anomalies in trade documents, transaction patterns, and counterparty behavior in real time. These tools flag suspicious activity early, helping prevent fraud and maintaining KYC and AML compliance.

- Embedded ESG criteria. ESG considerations are becoming integral to trade decisions, particularly in supply chain finance (SCF). It’s also becoming more important amongst banks, corporate treasurers, and CFOs. With the right platform, you can automatically embed ESG scoring and certification into trade workflows, banks and corporates can align finance with sustainability goals — while meeting emerging regulatory requirements.

Key Takeaways: From Compliance Burden to Competitive Advantage

Compliance is no longer optional or external to trade finance—it must be built in. The cost of non-compliance is high, but the cost of poor integration is often hidden in inefficiency and missed opportunities.

Modular, digital platforms offer the flexibility and scalability to adapt to evolving regulations and market demands.

As global trade becomes more complex, those who treat compliance as a core operational capability — not a constraint — will lead the way. Embedded regulation isn’t just good governance; it’s smart business.

Ensuring that AI and automation tools are part of your regulatory compliance trade finance workflow will make every operation smoother, more efficient, and more cost-effective. At LiquidX, we can help you with all of that.

Here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade, United States 2025

- Best Technology Vendor Of The Year, United States 2025

- Best Fintech For Trade, United States 2025

Banks and asset managers: To request a demo of our trade finance distribution solutions, click here.