Marriott Long Beach, Downtown, CA, August 14-15, 2025 ⏤ Dominic Capolongo (CRO) represented LiquidX at the 13th Annual Global Supply Chain Excellence Summit.

This summit is the work of The USC Marshall Randall R. Kendrick Global Supply Chain Institute (Kendrick GSCI), and is sponsored by Bank of America, and several other big names in the global supply chain sector, including Maersk, the Port of LA, the Port of Long Beach, and several others.

Our CRO, Dominic, attended and took part in one of the expert-led panel discussions over the course of the two day summit. It also gave him a chance to talk with clients, partners, and other stakeholders and professionals in the global supply chain and trade finance industry.

More about the panel Dominic participated in below.

Banking and FinTech Partnerships across Trade and Supply Chain Finance

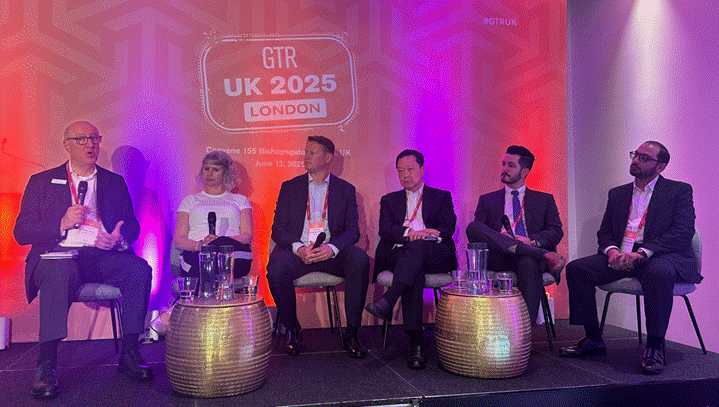

The panel was about how collaboration is driving innovation, efficiency, and resilience across global trade ecosystems.

The panel was led and moderated by Robert J. DeVincenzo, SVP for Global Banking Marketing at Bank of America (BoA), and the other esteemed panelists alongside Dominic were:

- Delvina Kolic (Director, Origination & Business Development, Orbian);

- Andrew Holmes (Head of North America Origination, FIS);

- Sarath Sasikumar (Co-Founder & President of Cleareye.ai).

The diversity on the panel made for a wide-ranging discussion spanning the current state of supply chain finance (SCF), the evolving options available to corporates, and the synergistic value to an efficient and effective physical supply chain.

Key Takeaways from the Banking and FinTech Partnerships Panel

Naturally, the panel also talked extensively about how technology has and continues to broaden the availability of supply chain finance and make managing a program more efficient and effective for corporates and banks.

As we have seen from our own data, which we will release soon, this is another reason asset managers are more active in recapturing the capital invested in the physical supply chain.

For Dominic, two things stood out from the panel discussion:

- There’s an improving partnership between fintechs and banks/asset managers. This is being shown in a much greater appreciation of the value fintechs bring to the table

- Every fintech is different, and an ecosystem of fintechs, each contributing its unique expertise to the greater supply chain and trade finance sector, is the best way for banks/asset managers to build the most resilient and flexible technology infrastructure.

All of this is very positive. The more that banks can do to incorporate and embed fintech solutions into their trade finance operations, the less reliant the sector will be on outdated, manual solutions, and the more innovative, agile, and robust the sector will become.

Moving corporates, banks, and asset managers away from these manual processes and into digital ones would save a lot of money and make trade finance transactions more robust, resilient, and secure.

AI in supply chain finance

AI integration within SCF and other trade finance systems is no longer a nice-to-have; it’s mission-critical.

As our CRO, Dominic Capolongo, said in Finance Derivative:

“The key advantage lies in AI’s pattern recognition capabilities. Rather than relying on fixed rules, machine learning models can identify complex relationships between different data elements.”

“When a buyer truncates an invoice reference or applies an unexpected discount, AI can still identify the correct match by recognising patterns in the remaining data points. This capability proves invaluable when reconciling transactions affected by tariff-related adjustments or partial payments.”

Continuing with this theme, about how AI can further support and enhance the supply chain finance sector. In another article, Dominic said in AI in Business:

“Sharper, more sudden fluctuations are being sparked not by the things we know are coming, but by the latest news headlines – particularly around the rapidly changing U.S. trade policy – and this unpredictability is triggering knee-jerk reactions across the market.”

“While market volatility shows no sign of settling, AI, specifically ML, does offer a solution in terms of how financial institutions handle the chaos.

“For trade finance, some of the main benefits of AI-powered reconciliation include:

- Ability to recognise patterns: One of the main capabilities of ML models is that they can identify complex relationships between different data elements, as opposed to relying on fixed rules.

This means that when a buyer truncates an invoice reference or applies an unexpected discount, AI can still identify the correct match by recognising patterns in the remaining data points – a benefit proving invaluable when reconciling transactions affected by tariff-related adjustments or partial payments.

- Scalable automation: Because AI can process new information instantly, it can both maintain up-to-date records and allow institutions to handle higher transaction volumes without increasing headcount.”

LiquidX Summer 2025 Recap

The USC Summit marks the end of our Summer season of sector-wide conferences and events. For a recap, here’s what else we got up to the Summer of 2025:

How Digital Advancements are Reshaping Customer Experience in International Banking, following LiquidX’s attendance at the 2025 Bankers Association for Finance and Trade (BAFT) Global Annual Meeting (GAM) in May.

LiquidX at ITFA: Innovations in Trade Finance Tech. Miami, Florida, 4 ⏤ 6 June, 2025 ⏤ LiquidX was delighted to attend and be a gold sponsor at the ITFA Americas (AMRC) 28th Conference.

LiquidX at GTR UK 2025: How will AI transform trade finance? London, England, UK, June 12, 2025

As we have seen and talked about time and again, at every panel we’ve attended this year, supply chain and trade finance is undergoing a long-overdue transformation.

AI is at the forefront — offering the potential to streamline operations and break down data silos.

For banks, asset managers, and corporates wanting to leverage the advantage of a connected SCF and working capital program, digitization is the only way forward, and that means using cutting-edge solutions like LiquidX that can:

- Upload any kind of document.

- Handle every type of data, and;

- Communicate (e.g., originate, distribute, buy, and sell) with systems that other players in the industry are using.

Until you go digital, you can’t take advantage of automation and AI in supply chain finance.

Here’s another great reason to work with us! In 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade, United States 2025

- Best Technology Vendor Of The Year, United States 2025

- Best Fintech For Trade, United States 2025

Corporations, banks, and asset managers: To request a demo of our trade finance distribution solutions, click here.