Generative AI is already slowly starting to transform trade finance, and in particular, trade finance risk management.

AI-driven analytics are helping banks and asset managers better predict counterparty risk, detect fraud, and optimise distribution strategies.

In a volatile global international trade environment, proactive risk management — supported and empowered with AI and automation — is becoming as important as transaction processing itself.

In this article, we look at the way AI can be used in trade finance, and how the sector is adapting and integrating AI-powered solutions.

The Cost of Manual Trade Finance Risk Management

Risk management and compliance can be an expensive ⏤ but regulatory and operationally crucial ⏤ part of trade finance.

An EY article notes that: “On average, a large trade finance bank can spend anywhere from $25m to $42m annually on risk, compliance, sanctions and anti-money laundering (AML) tasks – all without growing its business.”

One of the reasons for this is that trade finance is still stuck in manual and outdated ways of working.

Paper invoices. Excel spreadsheets. Even faxes.

In most cases, the first phase of any trade finance program is to digitize documents, ensure that everyone who needs access has it, and that records of counterparty documents and risks are aligned, stored, and categorized.

Manual work takes time and costs money, which is why banks and financial providers in the trade finance space spend so much money on it.

AI and digital tools with automation embedded into them can dramatically reduce the need for manual work, and the cost of risk management in trade finance.

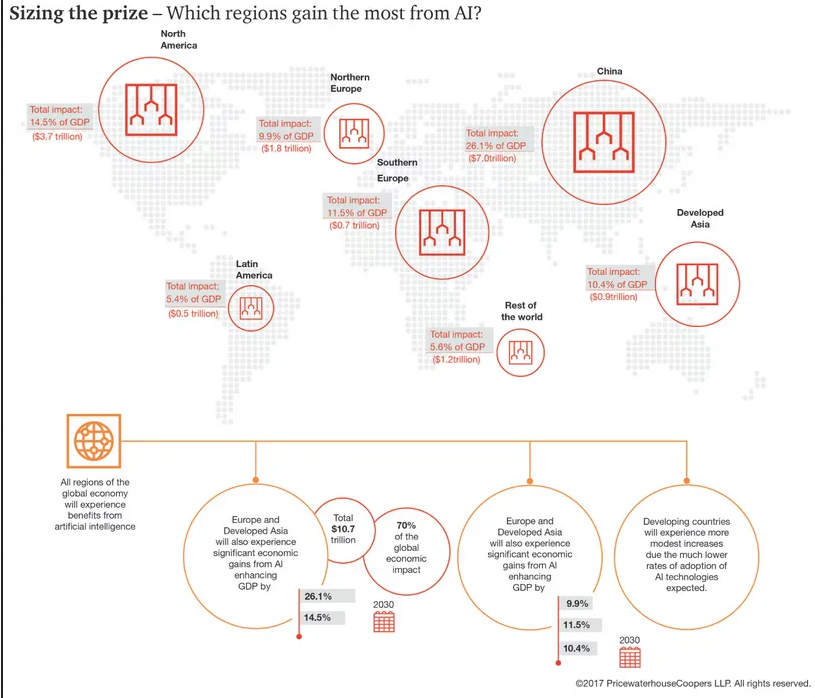

PwC is calling AI the “$15.7 trillion game changer.”

PWC is predicting that AI could: “Contribute up to $15.7 trillion to the global economy in 2030, more than the current output of China and India combined.”

This tremendous opportunity for growth is one of the many reasons investors are so excited about AI. In recent years, investors, tech and corporate giants, universities, and governments have invested $1 trillion into AI startups, scaleups, hardware manufacturers, and utilities to keep massive data centers operational for dozens of new AI models.

It’s one of the reasons OpenAI is currently worth $157 billion.

Table 1: PwC: AI is the $15.7 trillion opportunity

Above: PwC predicts which regions will experience the most gains from AI, with North America potentially gaining 14.5% of GDP, China 26.1%, and Northern Europe gaining 9.9% of GDP.

Now, let’s look at the ways that AI is and could be used in trade finance.

Use Cases for AI in Trade Finance, Including Risk Management

AI already plays a big role in the financial sector.

Banks, investment firms, and new AI-powered FinTech startups and scale-ups have been using AI in some form long before OpenAI, DeepSeek, Google’s Gemini, Anthropic Claude, and numerous others that have emerged in the last couple of years.

For example, automated trading algorithms (known as algo and quantitative trading) account for around 70% of trades on US exchanges. Even in 2018, a study by the Securities and Exchange Commission noted that “electronic trading and algorithmic trading are both widespread and integral to the operation of our capital markets.”

In 2024, an IMF Global Financial Stability Report noted that “AI’s ability to quickly rebalance investment portfolios will in turn lead to higher trading volumes.”

We are already seeing this in the exchange-traded fund market (ETFs). Traditional ETFs have portfolios rebalanced annually. AI-driven portfolios can do this every month.

Now, we have to acknowledge that trade finance products, like supply chain finance (SCF) and invoice factoring, don’t move as fast as stocks, bonds, or currencies.

Trade finance isn’t a stock market.

It’s a series of interconnected contracts, finance vehicles, and insurance products that cover these vehicles, and the underlying contracts and physical assets that underpin them (e.g., the traded goods themselves).

Because of this, transactions being agreed in microseconds aren’t essential in trade finance. There are other ways AI can be deployed, including the following:

- Risk Management, Compliance

Risk management and compliance are an essential part of trade finance.

If you can automate as much of this as possible, then that frees up resources for other, more profitable, or at least, revenue-focused tasks.

That’s where and how AI and automation software come into the picture. Taking manual tasks ⏤ like uploading invoices or assessing contracts for counterparty risk ⏤ and automating them.

LiquidX has an end-to-end digitization solution widely used by banks, asset managers, and other players in the trade finance space.

When you automate manual processes and digitize transactions across systems, you get better visibility and cash forecasting.

With LiquidX Digitize, you can turn any trade finance document into self-executing smart contracts that deliver upstream and downstream visibility to optimize the working capital lifecycle.

- AI Underwriting

As we’ve covered in previous articles, one of the advantages of trade finance is the low-risk nature of these financial instruments, which makes them attractive opportunities for banks and asset managers.

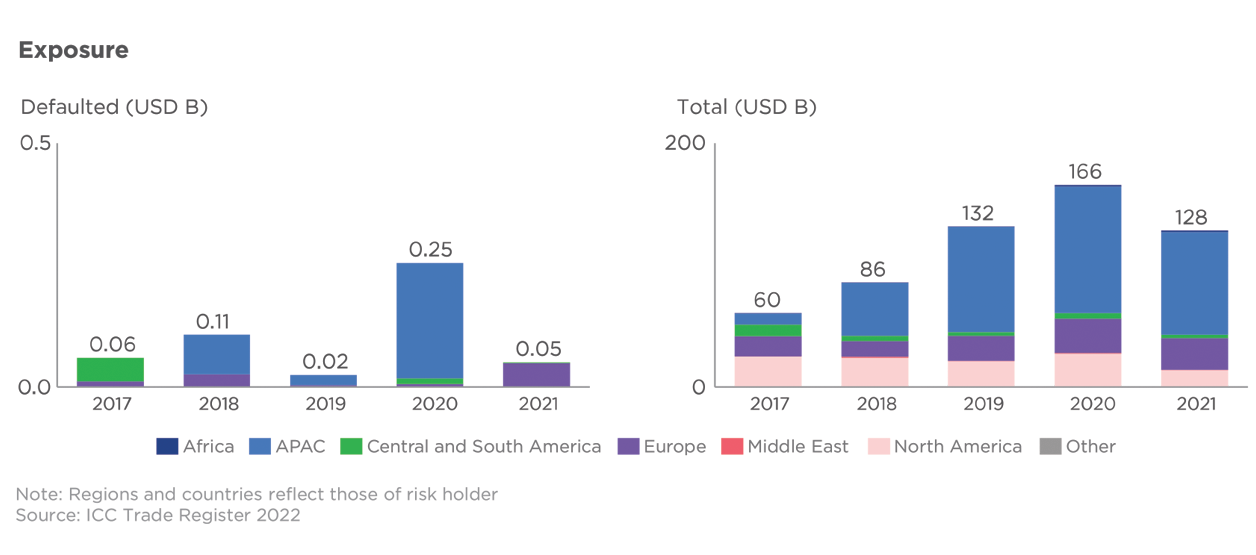

Table 1: Low default risk for trade finance distribution products

Low-risk and very low default rates for the following popular trade finance distribution financial instruments: accounts receivable (AR) and supply chain finance (SCF) (source)

However, low risk is not zero risk. Therefore, underwriting is still an important part of the process.

Various AI models like Decision Trees, Random Forest, Gradient Boosting Machines (GBM), and other Neural Networks can be used for underwriting purposes in trade finance. Back office solutions can integrate AI underwriting to make decision making more efficient and reduce the risk of human error.

- Fraud Detection, Prevention

According to EY, “An estimated $1 trillion of financial crime proceeds flow through the $9.1 trillion industry’s trade channels each year.”

As a result, KYC and AML are an essential part of any trade finance transaction.

Consequently, parties in trade finance transactions (buyers, sellers, and funders) need to carry out the usual fraud detection checks and safeguards.

As part of risk management, if you automate and use AI, it makes this process easier, more efficient, faster, and less prone to human error.

- Customer Service

Most banks, asset management firms, or providers in the trade finance space will have some form of customer service solution.

In almost every case, AI is already an embedded and normal part of customer service. The aim of using AI is to:

- Reduce customer service costs;

- Give customers answers and information quicker, and;

- Support customers more effectively 24/7, which is often too expensive with human agents.

Martin Moeller, Head of AI & GenAI for financial services, EMEA, at Microsoft, told Reuters: “Generative AI will reshape the competitive landscape.”

Moeller cites Klarna, a Swedish fintech, now using OpenAI and other AI tools to do the work of 700 customer service employees.

Talking about wealth management, UBS CEO Sergio Ermotti recently said: “Banks that have so far been barely active in wealth management could enter the business with the help of AI without having to invest much in customer advisors.”

The same can apply to trade finance. AI should make it easier to provide enhanced customer service at scale without the extra cost of increasing headcount.

- Predictive Analytics and Forecasting

Banks and asset managers need a way to forecast demand, assess who’d be a good buyer for trade finance assets at spread, and reduce counterparty risk and being overexposed to any one organization, sector, or transaction type.

For example, if you are holding $500M in a $1bn portfolio of short-term consumer goods transactions, it might be worth diversifying your portfolio. AI can help make this easier, with automated alerts and rebalancing trigger points.

Now, let’s review the 10 advantages of using AI in trade finance.

10 Advantages of AI in Trade Finance

Here are 10 key advantages of AI being deployed in numerous ways across the trade finance industry and value chains:

1. Increased operational efficiency

AI automates time-consuming manual processes such as document verification, compliance checks, and data entry, which are an essential part of trade finance work.

AI automation reduces bottlenecks, shortens processing times, and allows institutions to handle higher transaction volumes without the need to increase headcounts or outsource functions.

2. Improved decision-making

AI models analyze trade finance data, previous transactions, and credit histories to support more precise risk assessments. This helps trade finance teams make informed decisions on issuing letters of credit, guarantees, or extending lines of credit, while minimizing the chance of human error.

3. Operational cost reductions

Manual handling of trade documentation, sanctions screening, and credit assessments consumes significant resources. AI reduces these costs by automating routine tasks, enabling trade finance departments to redirect budget and talent to more strategic initiatives such as market expansion or customer development.

4. Advanced fraud detection

Like any financial sector, trade finance is susceptible to fraud like duplicate financing, document tampering, and false invoicing.

AI-powered systems can be deployed to detect anomalies in trade documents, transaction patterns, and counterparty behavior in real time. These tools flag suspicious activity early, helping prevent fraud and maintaining KYC and AML compliance.

5. Improved customer experience

AI enables faster transaction approvals and status tracking for banks, asset managers, and other players in the trade finance space.

AI also supports personalized communication based on client history and behavior. These capabilities enhance the client experience, strengthening loyalty and competitive positioning in a crowded market. As mentioned above, AI is also being used in a customer service capacity for banks and asset managers.

6. Faster document processing

Trade finance often involves processing invoices, certificates of origin, and customs documents. AI-driven optical character recognition (OCR) and natural language processing (NLP) accelerate document review and extraction, dramatically reducing turnaround times.

All of this makes digitization, which is the first stage in any trade finance transaction, including monetization.

7. Enhanced risk management

AI systems assess geopolitical events, commodity price shifts, and supply chain disruptions in real time. When this data is integrated with client credit profiles and transaction history, trade finance teams can proactively manage counterparty and operational risks.

8. Deeper market and trade insights

AI can aggregate and analyze global trade flows, pricing trends, and regulatory changes. This gives trade finance teams valuable insights into emerging opportunities and risks.

These analytics support smarter portfolio diversification strategies and can help spot opportunities when they emerge.

9. Automated regulatory compliance

As we mentioned, trade finance needs to comply with AML and KYC legislation, and trade sanction regulations. AI automates screening processes, improves accuracy, and ensures ongoing compliance.

Automated verifications reduce the risk of penalties and reputational damage (because there’s much less or zero chance of human error) while easing the compliance burden.

10. Smarter portfolio management

AI helps banks and trade finance providers optimize their trade finance portfolios by improving performance forecasting, identifying at-risk transactions, and suggesting ways to de-leverage risk. This improves how capital is deployed and, as a result, can increase financial performance.

Key Takeaways: An AI-Driven Future for Trade Finance

AI is here.

It’s quickly becoming a part of almost everything that people used to do 100% manually. This is already happening in trade finance.

We expect this trend to continue.

Ensuring that AI and automation tools are part of your trade finance workflow will make every operation smoother, more efficient, and more cost-effective. At LiquidX, we can help you with all of that.

Here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade, United States 2025

- Best Technology Vendor Of The Year, United States 2025

- Best Fintech For Trade, United States 2025

Banks and asset managers: To request a demo of our trade finance distribution solutions, click here.