As we’ve covered in other articles, trade finance is a fast-growing market. Most global banks already have a trade finance program of some description and size.

80 to 90% of world trade relies on trade finance, which is currently worth $9.7 trillion, with a CAGR of 3.1%.

One trade finance growth area is supply trade finance (SCF), which grew at a CAGR of 26% from 2017 to 2023, despite rising global protectionism and tariffs.

SCF continues to grow at a rate of “7% annually, currently worth $2.34 trillion, with funds in use at $916 billion,” according to the latest BCR Publishing’s World Supply Chain Report 2024. (2023 figures).

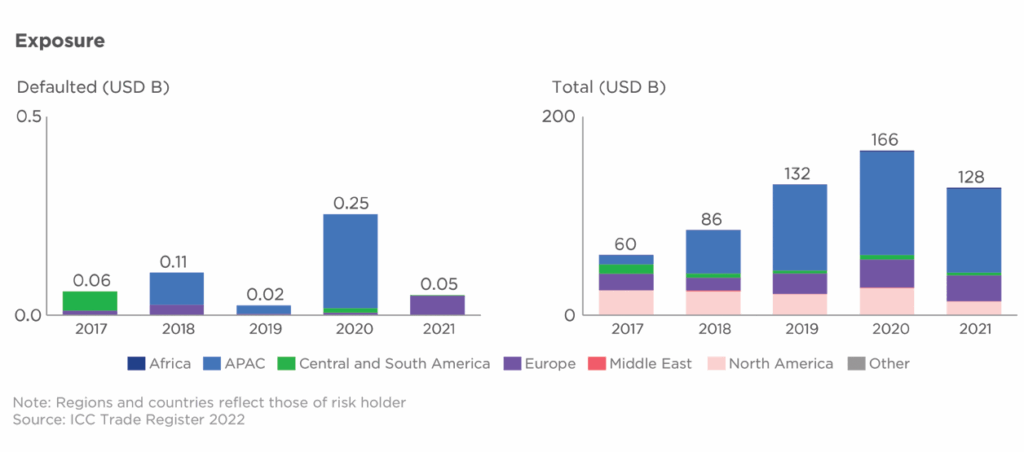

Alongside high growth rates, trade finance is very low-risk. Making this a an attractive asset class in turbulent times. In most cases, default rates are in the 0.25% to 0.5% range. *

Table 1: The default rates of trade finance distribution have always been low

Low-risk and very low default rates for accounts receivable (AR) and supply chain finance (SCF) (source)

Economic Headwinds Against Global Banks in 2025

Despite the attractiveness of trade finance as an asset class, 2025 has not been the best year to take risks for global banks.

One reason for this, at least for Tier 1 banks with over $100 billion on their balance sheets, is Basel III adoption, which comes with the more stringent financial capital requirements.

At the same time, research from S&P Global has uncovered the true and staggering cost of US tariffs since the start of 2025: $1.2 trillion.

S&P Global’s white paper is based on “information provided by some 15,000 sell-side analysts across 9,000 companies who contribute to S&P and its proprietary research indexes.”

The analysis is sobering: “Revenue expectations have risen — but earnings expectations have fallen — producing a 64-basis-point contraction in margin. If the pattern holds for firms without sell-side coverage, the cost shock would exceed $1.2 trillion in lost profit.”

“The sources of this trillion-dollar squeeze are broad. Tariffs and trade barriers act as taxes on supply chains and divert cash to governments; logistics delays and freight costs compound the effect,” author Daniel Sandberg said to CNBC.

Companies have also reported more than $35bn in tariff-related costs ahead of third-quarter earnings. However, many are lowering initial forecasts, according to a separate Reuters analysis of hundreds of corporate earnings statements.

And yet, despite these many macroeconomic and geopolitical challenges, global banks are maintaining steady growth.

Diversification is one reason for this, and trade finance, with its many types of asset classes and rates of return on capital invested (and the ability to profit from distribution), is a key diversification mechanism for global banks:

- Supply Chain Finance

- Invoice Discounting

- Payables Finance

- Accounts Receivable

- Invoice Factoring

- Pre- and Post-Shipment Financing

- Distributor Financing

- Reverse Factoring

The Need for Off-Balance Sheet Profit-Drivers

The 2025 ICC’s Trade Register report confirms what we have been saying: Basel 3.1 is fundamentally changing the economics of trade finance.

When on-balance sheet products become capital-intensive, banks face a critical choice: either significantly increase pricing or find more efficient ways to manage risk and capital.

For LiquidX, this isn’t just a challenge — it’s an opportunity. Our platform provides the strategic necessity the ICC highlights: a mechanism for banks to offload trade assets efficiently, manage their capital exposure, and maintain client relationships without prohibitive pricing.

The future of trade finance is about intelligent distribution and liquidity. We’re here to help banks make that transition seamlessly.

How LiquidX Can Support Global Banks Trade Finance Programs

Speaking at a TTP rooftop event in New York that we hosted, Jordane ROLLIN, Managing Director and Head of Trade Finance and Working Capital, GTB Products at TD Securities, said:

“Historically, banks and corporates were looking at ways to get more efficient in reconciling POs and invoices and making sure that data matched when they received various payments.”

“The client benefits are first about turnaround time, and then efficiency as well… Whereas before you would have to think about how to remove the paper from the equation, now, if you have a technology that allows you to extract data from paper and then run the checks directly, you don’t need to change as many of your processes. That’s what’s helping both banks and corporates.”

In most cases, global banks already have an active trade finance program. However, there are usually areas where efficiencies can be improved.

For that reason, global banks tend to need one or more FinTech SaaS partners like LiquidX, with our modular solutions to fill some of the gaps. Here are the modules that global banks can choose from:

- Trade finance software that can take in any invoice format (e.g., XLSX, PDF, etc.), and use that as workable data downstream across the trade lifecycle.

- Trade: Automatically digitizes assets in the front office.

- TradeHub: Manages portfolio risk with ease.

- TradeOps: Make significant back office savings; up to 50% savings compared to in-house back office software.

- InMatch: Can handle reconciliation challenges for asset managers.

Every module includes the advantages of a deep partnership with Broadridge (NYSE: BR), a trusted global fintech leader.

Broadridge is LiquidX’s largest committed investor and strategic operational services provider for payment processing, account reconciliation, and global operational scalability.

Everything we offer meets the needs of global banks in the trade finance and working capital monetization market. Our software handles tens of billions of dollars worth of transactions every year, and we’re already working with some of the world’s largest and banks.

Here’s another great reason to work with us! In 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade, United States 2025

- Best Technology Vendor Of The Year, United States 2025

- Best Fintech For Trade, United States 2025

Banks: Get a demo of our trade finance solutions. Find out why 100+ financial sector firms trust us to deliver multi-billion dollar trade finance programs.