Since 2021, and including the first 6 months of 2025 (H1), we have processed over $76.5 billion in trade finance transactions. We will be updating this and other articles in January 2026 once we’ve run the numbers for the second-half of 2025, to give you a full five-year view of the trade finance transactions we’ve processed.

Within those 4.5 years of growth, 74% are banking sector client transactions, and 26% are from asset management firms.

LiquidX’s latest data reveals a compelling shift in trade finance: asset management participation has surged 48% from 2021 to 2025.

This year, it represents 35.65% of total transaction volume in ($3.55B out of $9.97B), so far.

Let’s understand more about that and why this is happening.

Asset Managers: Transforming Trade Finance

Here is how asset manager participation has evolved since 2021:

- 2021: 21% asset management participation

- 2024: 31% asset management participation

- 2025 H1: 36% asset management participation

This is a fundamental shift in how institutional capital is accessing trade finance opportunities.

With over $76.5 billion processed since 2021, LiquidX is at the center of this transformation.

Asset managers are recognizing trade finance as a compelling alternative investment, offering diversification and attractive risk-adjusted returns in an evolving market landscape.

Asset managers have grown from 21% to 36% of transaction volume. This impressive 48% increase signals institutional capital’s growing appetite for trade finance as an asset class.

Why Are Asset Managers Hungry For Trade Finance?

As our CRO, Dominic Capolongo, says: “This is our first time making our data public, and we are delighted to have taken this step. Since 2021, trade finance transactions through the LiquidX platform are up 431% in 4 years.”

“What started as a trickle is now becoming a flood, as a growing number of asset managers are seeing this as a higher-yield, lower-risk asset class than many others.”

“Asset manager transactions increased from 21% in 2021 to 31% in 2024 ⏤ a growth rate of 48% in 4 years, with 26% of transactions during that time involving asset managers.”

As we’ve noted previously, trade finance is relatively low-risk, self-collateralized, and generates healthy returns in a short timescale.

For those reasons, asset managers ⏤ especially in private credit and debt ⏤ trade finance, are an increasingly attractive market to get into.

As a result, asset managers are investing in this market ⏤ both originating and distributing ⏤ as a way of generating higher returns compared to other asset classes like real estate or bonds.

Casey Talbot, CIO, Credit, Jain Global, comments: “Origination and servicing are important components for working capital strategies. We value counterparties who can and do provide institutional scale and support and have robust infrastructure and capital support.”

Another leading European asset manager weighs in on this: “As asset managers, working capital finance offers short-duration, low-volatility exposure with attractive diversification. The global trade finance gap exceeds $2.5 trillion, driven by bank retrenchment and new regulatory constraints.”

“With working capital finance, typical maturities range from 90 to 180 days, with annualized returns between 2% and 5%+ over base, and historic market data showing default rates below 0.5%. This makes it a compelling alternative to traditional fixed income, especially in volatile or rising-rate environments.”

“Innovative platforms, like LiquidX, are reshaping the trade finance landscape, streamlining origination and expanding user choice. These technologies enable greater transparency, operational agility, and scalable execution. Leveraging our deep credit knowledge and integrated digital systems, we build portfolios designed to manage risk and generate uncorrelated returns — anchored in real-economy flows.”

Guy Brooks, Managing Director, Working Capital Finance, Pemberton Asset Management

Volatile Public and Private Financial Markets in 2025

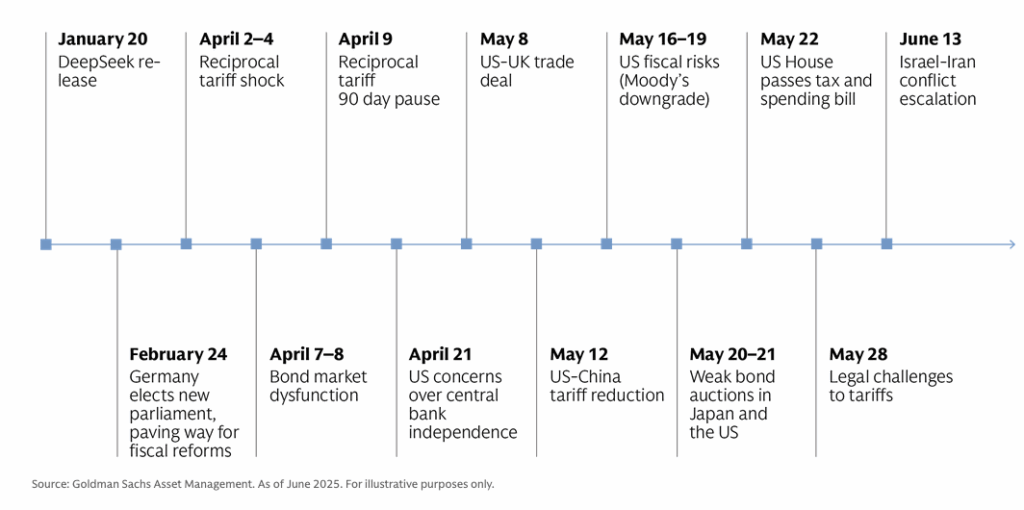

Since the start of 2025, volatility has been the nature of the game across every asset class and financial market.

In Goldman Sachs’ Mid-Year Outlook, they are encouraging asset managers and investors to “Recalibrate their portfolios.”

The reasons for this “include the unfolding impacts of tariffs, US fiscal risks, unusual dollar dynamics, conflict escalation in the Middle East, and European fiscal initiatives. The rapid advance of artificial intelligence (AI) is adding another layer of disruption.”

“We believe this evolving landscape demands a halftime reset—not a retreat. In our view, it’s important to stay invested, stay active, and diversify portfolio exposures across regions, sectors, and factors.”

Volatility since January 2025

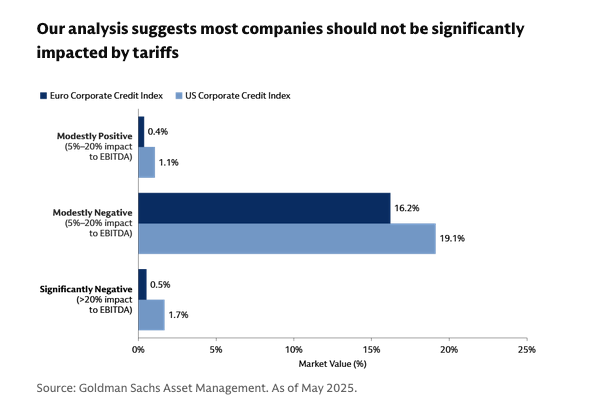

However, a bit of good news is that not as many companies as we might expect have been affected by tariffs.

At the same time, there’s more than just tariffs impacting asset managers’ appetite for trade finance.

Basel III Impact on Trade Finance

Another reason for asset managers to get into trade finance is the impact of Basel III.

As we’ve noted previously, trade finance isn’t overly affected by Basel III Endgame rules directly.

As the IMF said, the 37 Tier-1 banks (with over $100 billion on their balance sheets) can monetize trade finance without worrying about Basel III because trade finance is “low-risk, highly collateralized . . . with a very small loss record.”

With default rates under 0.25%, this gives trade finance products a certain amount of safety from being burdened with Basel III rules, making them an even more attractive asset class in these uncertain times.

However, because banks have more stringent capital requirements, it might force the cost of trade finance up for SMEs. At the same time, this gives asset managers another avenue into the market. Taking a more active role in the market, especially for private credit providers.

Yet again, we’ve not seen any reduction in appetite from banks in 2025, and we are monitoring this closely throughout the rest of the year.

Now, even if we look at Basel III and the current economic environment as micro and macro trends, the fundamentals behind investing in trade finance are inescapable for asset managers:

- Low risk

- Higher returns

- Self-collatoralized

- Short term

- Easily insurable

- Easy to buy or sell

And crucially, better returns than higher-risk, more long-term asset classes, making them too attractive to ignore.

Regardless of the type of trade finance vehicle, the outcomes for investing are the same, and this contributes to a well-balanced, risk-adjusted portfolio.

In this economic environment, that’s exactly what asset managers and their clients need.

How Asset Managers Can Access Trade Finance Opportunities

The most effective way to get into this market is to use trade finance software solutions to facilitate the entire end-to-end process.

It might be tempting to ask: Would it be better to have in-house software custom-built for this purpose?

In our experience, it’s not worth the time or capital investment.

If you want to upgrade how you’re currently managing working capital investments, or start from scratch, it’s quicker and easier to work with a software provider who can have you up-and-running quickly, and who can manage everything for your firm.

LiquidX’s suite of trade finance solutions can handle everything, with a smooth-running turnkey front-, middle-, and back-office operation that manages the entire origination to reconciliation lifecycle.

Our software is also ideal for asset managers who want to monitor trade finance investments within their larger portfolio. This way, you can track invoices and data involved in funding this asset class and when to expect a return on the capital invested.

Here’s what you can benefit from when you partner with LiquidX:

- Trade finance software that can take in any invoice format (e.g., XLSX, PDF, etc.), and use that as workable data downstream across the trade lifecycle.

- Trade: Automatically digitizes assets in the front office.

- TradeHub: Manages portfolio risk with ease.

- TradeOps: Make significant back office savings; up to 50% savings compared to in-house back office software.

- InMatch: Can handle reconciliation challenges for asset managers.

- Includes the advantages of a deep partnership with Broadridge (NYSE: BR), a trusted global fintech leader. Broadridge is LiquidX’s largest committed investor and strategic operational services provider for payment processing, account reconciliation, and global operational scalability.

Everything we offer meets the needs of asset managers in the working capital monetization market. Our software handles tens of billions of dollars worth of transactions every year, and we’re working with some of the world’s largest asset management firms and banks.

Want to shape the future of trade finance? Share your views with 1000s of other professionals in our sector?

Below is a survey you can take part in, with a whole load of benefits you need to know about.

Share Your Views & Expertise for our eBook: “State of Trade Finance 2026”

For the first time since we launched LiquidX in 2016, we are initiating a global survey of trade finance experts. That’s right, we want to know your thoughts, views, and expert opinions on the overall state of trade finance.

Once the survey is complete, and enough responses gathered ⏤ we expect by October ⏤ we will start compiling our exclusive eBook, which we’ll launch in January 2026: “State of Trade Finance 2026: Past Learnings, Forward Thinking.”

We want to hear from as many professionals and leaders as possible across the trade finance sector, including but not limited to:

- Banks

- Asset managers

- FinTech & TradeTech SaaS

- Insurers & Re-insurers

- Law firms

- Importers and exporters

- Corporates

- Shipping companies

- Trade finance providers

- Export credit agencies

- Third-party service providers

Take 5 minutes to complete our survey, and we’ll send you the finished eBook before it’s published. Your quotes will be amplified via our PR, social media, and email marketing channels ✅

What do survey participants get?

Because we’re asking for a few minutes of your time, we feel it’s only right to give you something in return.

Because we’re asking for a few minutes of your time, we feel it’s only right to give you something in return.

Here is what you’ll get:

✅ An exclusive Trade Finance Industry Briefing: How to Navigate, Mitigate Risk, and Accelerate Growth Opportunities in 2025. In this you will:

✅ Learn how to access the $2.5 trillion untapped trade finance gap in emerging markets

✅ Discover why supply chain finance grew 26% CAGR from 2017-2023 despite global headwinds

✅ Understand how to monetize $6.9 trillion in corporate cash reserves sitting idle

✅ Master Basel III implementation without disrupting your trade finance operations

✅ Turn tariff chaos and supply chain disruptions into competitive advantages

✅ Leverage AI-powered risk management while competitors still use manual processes

✅ You’ll gain access to the exclusive eBook before it’s published in January: “State of Trade Finance 2026: Past Learnings, Forward Thinking.”

✅ And unless you choose to remain anonymous (which everyone is free to do), we will amplify your hot takes, opinions, and expertise via our PR, social media, and email marketing channels.

Join the conversation that’s defining the future of trade finance – your expertise is exactly what the industry needs to navigate unprecedented change.

Banks and asset managers: To request a demo of our trade finance distribution solutions, click here.