On 1 July 2025, the latest implementation phase of the Basel III rules started to come into effect.

Known as Basel III Endgame, which sounds like a Dan Brown thriller you might pick up at the airport, it’s the start of a 3-year phase-in period for capital requirements.

The question for banks, corporates, and asset managers in the trade finance sector is: How does this impact trade finance?

The good news is that trade finance shouldn’t be overly affected by Basel III Endgame rules.

As the IMF noted, the 37 Tier-1 banks (with over $100 billion on their balance sheets) can monetize trade finance without worrying about Basel III because trade finance is “low-risk, highly collateralized . . . with a very small loss record.”

With default rates under 0.25%, this gives trade finance products a certain amount of safety from being overly scrutinized and burdened with Basel III rules, making them an even more attractive asset class in these uncertain times.

However, because Basel III has emerged as a result of the devastating impact of the Great Recession (2007-09), the Basel Committee for Banking Supervision (BCBS) hasn’t ignored or left any area of finance untouched.

With that in mind, let’s consider any more subtle changes any financial organization might have to make during the 3-year phase-in period to ensure they’re compliant with Basel III.

What is Basel III?

Before we dive into the impact of Basel III on trade finance, let’s refresh our knowledge on what Basel III is.

Basel III is a far-reaching set of reform measures aimed at strengthening the regulation, supervision, and risk management practices within the global banking sector.

Developed by the Basel Committee on Banking Supervision (BCBS), these reforms were introduced in response to the shortcomings in financial oversight exposed by the 2007–2008 global financial crisis.

BCBS is based in Basel, Switzerland, and it brings together 45 representatives from central banks and banking regulators across 28 jurisdictions. BCBS is mandated to improve the resilience of the banking system and ensure global financial stability.

Basel III builds on the foundations laid by earlier accords — Basel I, introduced in 1988, and Basel II, launched in 2004. Basel I focused on credit risk and set minimum capital requirements, while Basel II expanded the framework to address capital adequacy, risk sensitivity, and market discipline.

Basel III advances these efforts further, aiming to ensure banks are better equipped to absorb economic shocks, manage risk more effectively, and operate with greater transparency. No one wants a repeat of the global financial crisis, and ultimately, that’s the aim of the Basel III reforms.

National regulators are then obliged to implement those reforms in their jurisdictions, to ensure that banks and financial institutions adhere to the new regulatory framework.

Basel III and banks: Summary of the core requirements

(Source)

Now, let’s investigate the role this will play across the trade finance sector in the years to come.

The Scope and Size of the Trade Finance Sector

Let’s start with the fact that this is a big sector with numerous players, and there are many different versions of trade finance.

80 to 90% of world trade relies on trade finance, which is currently worth $9.7 trillion, with a CAGR of 3.1%.

Banks are central to the trade finance ecosystem by not only providing working capital to corporates in need of cash, but increasingly leveraging digital platforms to distribute these assets to a broader set of investors — enhancing liquidity, optimizing balance sheet usage, and generating additional yield.

And we mustn’t forget asset managers; we’ve seen more and more of them getting into this underappreciated and not always understood asset class in recent years.

There are numerous types of trade finance, including but not limited to the following:

- Supply Chain Finance (SCF)

- Accounts Receivable (AR)

- Invoice Factoring (IF)

- Pre and Post-Shipment Financing

- Distributor Financing

- Reverse Factoring

There are also numerous players in this vast interconnected market:

- Asset managers

- Corporates

- Banks

- Insurers

- Importers and Exporters

- Shipping Companies

- Non-bank, Trade Finance Providers

- FinTech SaaS Providers

- Export credit agencies and third-party service providers

Trade finance is a growing market, and that potentially makes regulators look more closely at it.

One growth area is supply trade finance. It grew at a CAGR of 26% from 2017 to 2023 despite an increase in global protectionism and tariffs.

SCF continues to grow at a rate of “7% annually, currently worth $2.34 trillion, with funds in use (FiU) at $916 billion,” according to the latest BCR Publishing’s World Supply Chain Report 2024. (2023 figures).

There’s also a massive opportunity gap in the following countries and regions: Africa, Asia, China, India, and the United Arab Emirates (UAE), worth $2.5 trillion, according to the International Asian Development Bank.

It’s one of the reasons Trade Finance Global launched the TFG Distribution Finance initiative in July 2023. The aim of this and similar initiatives is to:

“Identify and address unmet demands in the trade finance market, working towards closing the $2.5 trillion trade finance gap – a significant barrier to international trade impacting mid-market companies and small to medium-sized businesses in particular.”

Now, let’s look at what the industry is saying about Basel III, and any possible consequences of new capital requirements for banks.

Basel III Compliance: What changes might be needed between now and June 30, 2028?

For banks in particular, there are three main areas they will need to work on during this 3 year phase-in period:

- Capital requirements: Maintaining a minimum capital ratio of 8%, as per Basel I (Tier 1 + Tier 2 capital), “with greater emphasis on higher-quality forms of capital.”

- A new leverage ratio framework: Although 8% remains the same, it’s the ratio framework that means banks are going to have to “increase the amount of capital they have on hand by up to 20% over what they normally keep in reserve.”

- Liquidity requirements: “The ratio is Tier 1 capital divided by the bank’s total assets, with a minimum ratio requirement of 3%.”

Naturally, industry bodies and lobbying groups for the financial services sector aren’t happy about this.

The Bankers Association for Finance and Trade (BAFT) said:

“BAFT supports the intent of the Basel III reforms … However, we are concerned that the proposed framework will likely have unintended consequences that negatively affect the availability of credit and liquidity supporting international commerce conducted by US companies.”

The main concern is that: “Basel Endgame could lead to reduced lending, particularly to small and medium-sized enterprises (SMEs), as banks might become more risk-averse due to higher capital charges for loans.”

“The (BAFT) document addresses specific aspects of trade finance treatment under Basel III, advocating for adjustments to better reflect the low-risk nature of trade finance products.”

“It suggests modifications to defaulted exposure rules, advocating for operational delays not to be treated as credit defaults, especially relevant for supply chain finance.”

Trade Finance Global is concerned about the following consequences of Basel III rules:

“Since banks must hold more capital against their assets, including off-balance sheet items common in trade finance, like letters of credit, the cost of providing these services could rise.”

“This increase in cost might be transferred to customers, potentially making trade finance more expensive and less accessible, especially for SMEs and businesses in emerging markets that are deemed riskier.”

“The stricter liquidity requirements require banks to hold high-quality liquid assets to meet short-term obligations and have stable funding for their operations. This could incentivise banks to favour short-term, liquid trade finance instruments, possibly leading to a shift in the types of trade finance products offered.”

Growth-at-risk (GaR) impact assessment on the Eurozone financial system

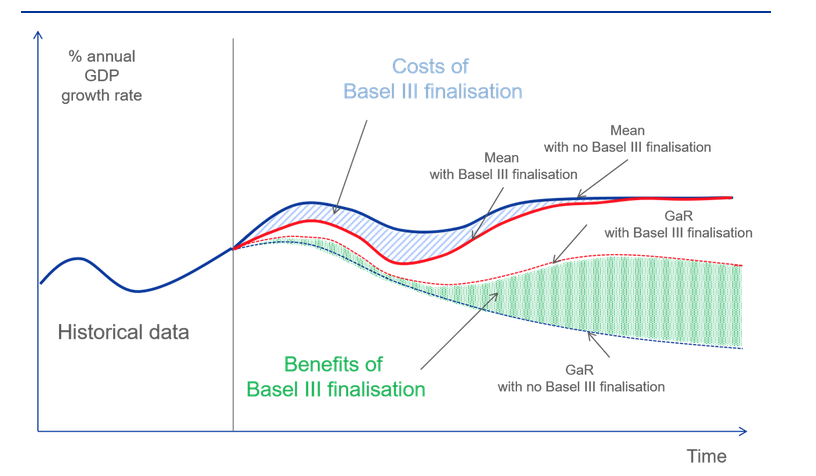

A study by the European Central Bank System, Eurosystem, shows that: “A positive difference between the 10th percentiles of the distributions, represented by the green area in Chart 1, would therefore show the benefits of the Basel III finalisation which stem from improved financial intermediation when the economy is hit by a crisis.” (Source)

Key Takeaways: What does Basel III mean in the short term?

At this stage, trade finance remains unaffected by Basel III rules.

The financial services and trade finance sectors are simply at the start of a 3-year period of adjustment.

During this time, banks will have to adjust their liquidity and capital requirements and ratios.

Down the road, this may impact what trade finance products are offered, or they might be offered at higher rates of interest, especially in developing countries.

Or they may not. In the greater context of economic uncertainty worldwide, trade finance will simply adapt gradually, as it always has done.

We are in a period of growth for the sector, and new economic and geopolitical realities, and all of that has a more immediate impact on the flow of trade finance. As of 1 July, we have not noticed any major up or downticks in the flow of funds, demonstrating the resilience of trade finance in an evolving landscape.

Ultimately, Basel III Endgame rules must be taken in context. Regulators are always making changes, and as this is a global industry, those periodic and gradual adjustments are felt more like the aftershocks of an earthquake, rather than anything as disastrous as an earthquake.

For the trade finance sector, whichever side of the deal you are on, Basel III Endgame might sound ominous, but it’s not an immediate concern. The sector will have evolved by the time any rule changes are actually felt in practice.

Whatever happens with Basel III and it’s impact on trade finance, we are here to help. Let us navigate new waters together.

Here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade, United States 2025

- Best Technology Vendor Of The Year, United States 2025

- Best Fintech For Trade, United States 2025

Banks and asset managers: To request a demo of our trade finance distribution solutions, click here.