Menu

Close

Close

Monetize with

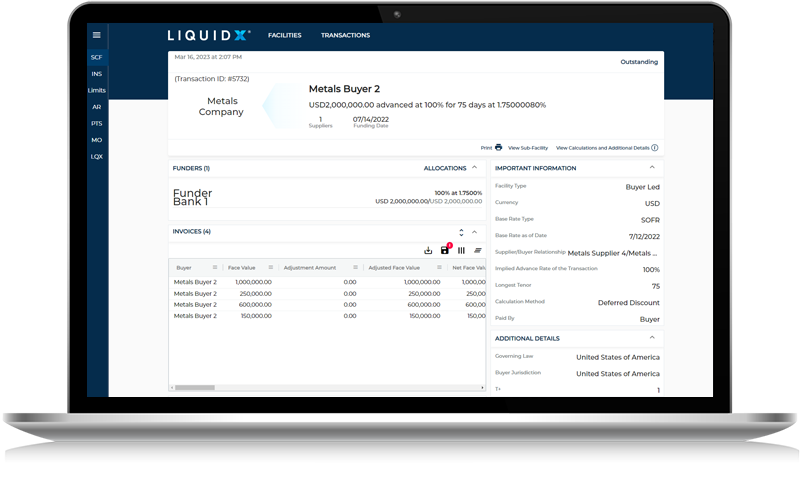

Trade is a complete front office trade finance solution to originate and distribute Accounts Receivable, Payables and Asset Distribution transactions across any and all transaction types. Corporates and Banks leverage LiquidX’s Trade platform for their trade finance needs.

From a single bilateral transaction to complete and complex multi-funder transactions, the platform provides onboarding with KYC requirements and legal documents and can support programs structured as true sale or financing.

Asset

Distribution

Companies can leverage our platform to launch their own supply chain finance or receivables program, while Financial Institutions can white-label and sell our technology to their own customer base.

Leverage Our Comprehensive Platform to Scale Their Businesses

Liquidx has diligently developed a compelling solution to support the business requirements and provide an end to end solution from the sale of the receivables by the Seller to the distribution to the participant banks, including eligibility checks, calculation, notification and reporting to all applicable parties, including participant banks. It allowed CACIB to automate many manual tasks performed by its middle office and to eliminate operational risk and improve the quality of service provided to the seller, including full visibility in real time to activities and data.

CACIB faced inefficiencies in its trade finance operations due to manual processes for document handling, compliance checks, and communication between parties, resulting in slower workflows, higher operational risks, and limited scalability to support complex transactions.

By leveraging LiquidX’s white-label technology and distribution capabilities, CACIB automated key middle- and back-office processes, enabling streamlined deal management, enhanced reporting for funders and participants, and improved risk mitigation. This partnership not only increased operational efficiency but also enhanced the quality of service provided to clients, enabling CACIB to scale globally and manage $1.5B in accounts receivable programs effectively.

© 2025 LIQUIDX. All rights reserved.