The following article appeared in the Global Blockchain Business Council annual report 2021, “Coming Together: Forging Collaborations in an Era of Profound Change.”

LiquidX provides leading technology solutions to automate and optimize the entire finance supply chain, including working capital, trade finance, and trade credit insurance. InBlock is the asset digitization engine leveraging the Hyperledger fabric to digitize and connect the Purchase Order, Inventory, Invoice, and associated workflows and cash records of the asset.

The Challenge

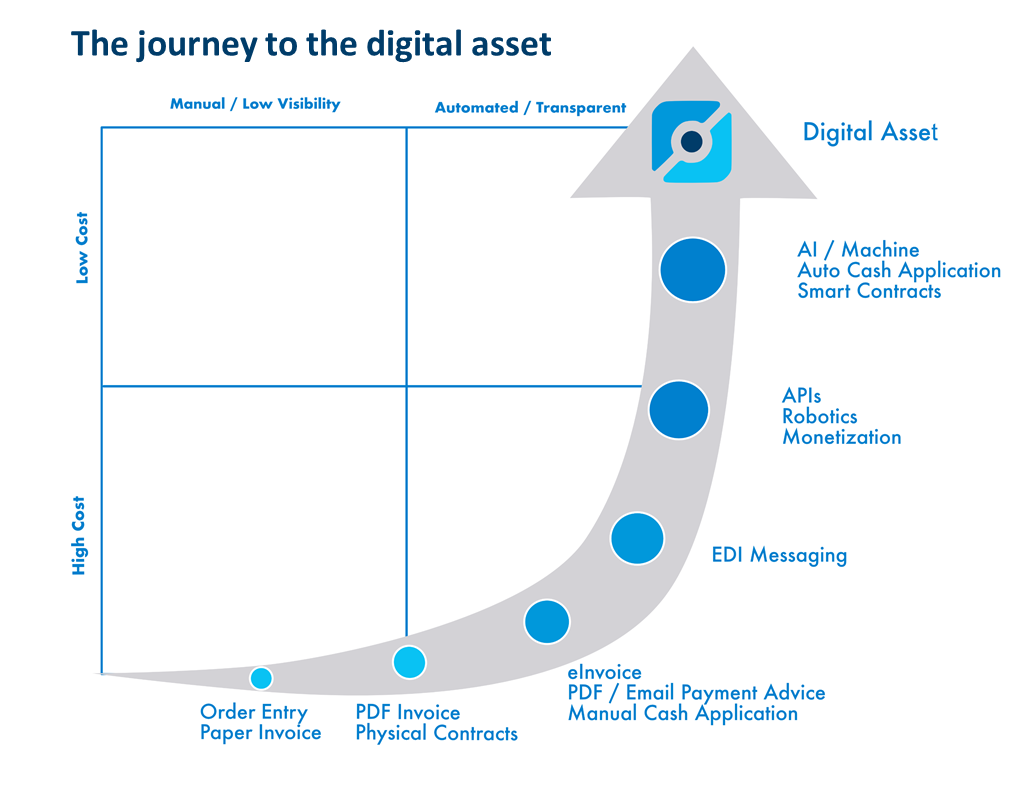

The working capital process includes a significant amount of paper and manual processes that create cost and complexity. The accounts payable process must receive invoices from suppliers and digitize the invoices for goods receipt match and payment. The order-to-cash process must ensure a scalable way to receive and apply the cash to open invoices. The goal of a truly digital process is limited by the promise of automation through PDFs, which still require human interaction.

In addition to the manual processes, traditional systems are single facing, providing a current view only to their user. These systems lack the visibility across the network for order processing, shipment delays, returns, and disputes, creating manual, bespoke processes that utilize email and excel spreadsheets.

The Solution

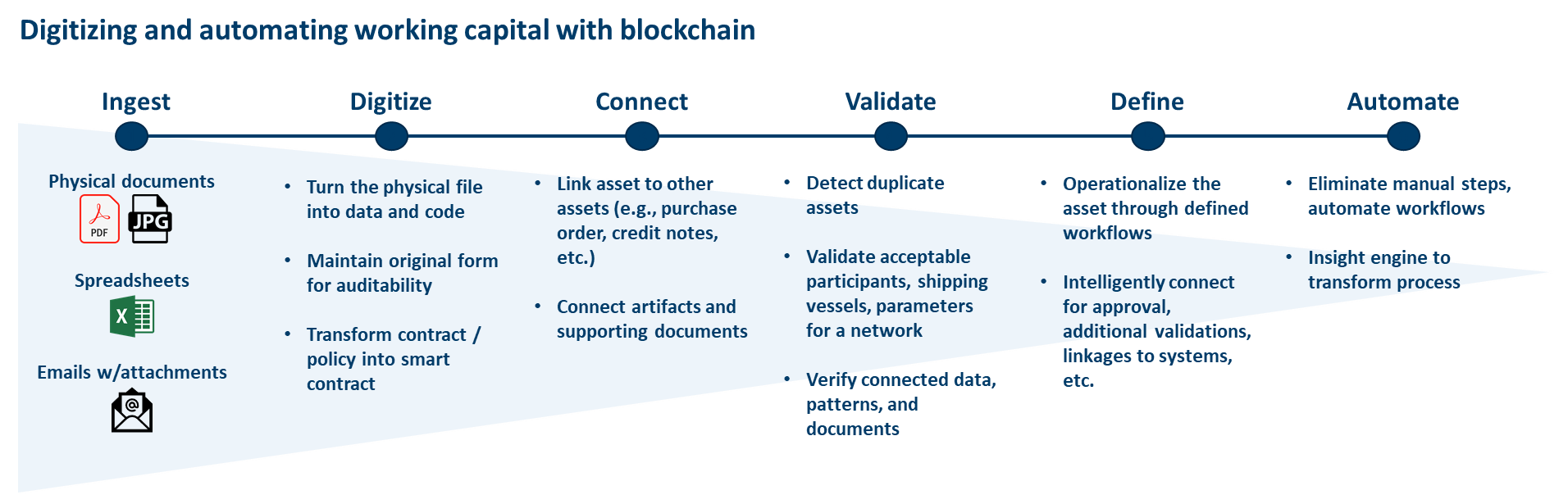

InBlock leverages industry leading technology that transforms the working capital processes for our clients, turning a physical invoice into data and recording the asset on the DLT. Whether the invoice arrived through a physical document or through our ERP adapters, InBlock can run the validation routines on the assets to detect duplicates, origination, etc. Once an asset is InBlocked, it can then be managed through our integrated workflows for AP, AR and Intercompany or financed through available programs. Our clients benefit from the real time updates to the cash flows eliminating the manual effort of compiling the cash forecast.

Blockchain technology provides a shared ledger view where all participants have access to the most current state of the asset. Through smart contracts, we can connect and govern assets with their master agreements, policies, etc.

The Results

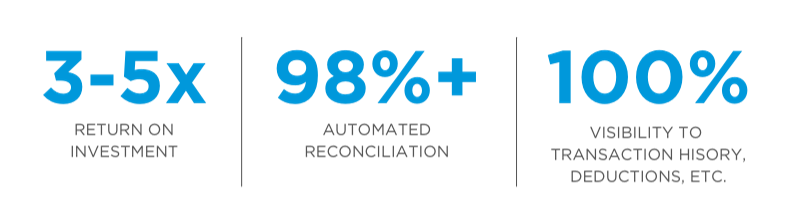

Our clients experience real time, shared visibility to the AR, AP and Intercompany processes eliminating the manual chasing and reconciliation with their participants.