LiquidX’s Trade Finance Distribution software is a complete front office trade finance solution to originate and distribute Accounts Receivable, Payables and Asset Distribution transactions across any and all transaction types.

Banks, asset managers, and corporates leverage LiquidX’s Trade platform for their trade finance needs.

From a single bilateral transaction to complete and complex multi-funder transactions, the platform provides onboarding with KYC requirements and legal documents, and can support programs structured as true sale or financing.

What is Trade Finance Distribution?

Trade Finance Distribution involves two or more parties in the transaction.

You’ve got the original financial vehicle, like a manufacturer sending a large invoice to a big corporate customer. The manufacturer needs payment to pay their staff and suppliers.

This is known as Invoice Discounting or Payables Finance, and that’s where a big corporate (the customer) steps in, and asks one of the banks they bank with to extend their manufacturer(s) and supplier’s credit.

The bank, happy to accept, does this, but doesn’t want to sit with it on its balance sheet. So, they originate and purchase the receivables, and then distribute it, known as the “originate-to-distribute” (OTD) model, where the bank sells the trade finance assets to other investors, like asset managers.

There are numerous ways this can happen, like Supply Chain Finance (SCF), Accounts Receivable (AR), and even more configurations of the parties involved.

Trade finance is the movement of money to facilitate and make international and cross-border trade easier. Trade finance distribution is an evolution of that; it’s the carrying of capital risk and rewards.

Every party in the transaction makes a profit, and it’s a massively risk-adjusted asset class because every asset within the financial vehicle is in some way supported – either by physical goods, invoices, pre-agreed funding, or insurance.

There are numerous types of trade finance, including but not limited to the following:

- Supply Chain Finance

- Invoice Discounting

- Payables Finance

- Accounts Receivable

- Invoice Factoring

- Pre- and Post-Shipment Financing

- Distributor Financing

- Reverse Factoring

All of the above are niches of the larger “trade finance” market, and all of these are classed as alternative asset investment vehicles.

There are also numerous players in this vast interconnected trade finance market:

- Banks

- Asset managers

- Corporates

- Manufacturers and the wider supply chain

- Insurance firms (particularly those that focus on transport, logistics, and manufacturing)

- Importers and exporters

- Shipping companies

- Shipping and transport brokers

- Non-bank, trade finance providers

- FinTech SaaS providers

- Export credit agencies and third-party service providers

Any party can act as an originator for a distribution deal. However, in most cases, the originator is usually a financial provider, like a bank, an asset management firm, or a corporate treasury.

Any party can also act as a buyer or intermediary, depending on the deal terms. That’s one of the things that makes trade finance distribution so attractive is the fluidity of the market.

Distribution financial vehicles can be anything from short-term, relatively small bundles of finance, like $1M over 90 days, or much larger and longer-term assets.

How Banks & Asset Managers Can Get Into The Trade Finance Distribution Market

Banks, institutional investors, non-bank lenders, and alternative credit funds are already active players in the trade finance distribution market.

Many are getting into and scaling-up distribution in a big way in 2025, and we expect that to continue into next year and beyond.

At the same time, we’ve seen a lot more asset managers get into this market in the last few years.

Asset managers are injecting capital as a way of generating higher returns compared to other asset classes like real estate or bonds. It’s proving a great way to offset portfolio risk, especially if a portfolio is holding onto too many stocks, bonds, and ETFs.

The good news is that you can get into this market without increasing headcount.

Your company can also scale trade finance distribution without having custom software built.

Size of The Trade Finance Distribution Market

As we’ve covered in other articles, the trade finance market and subsequent distribution market are huge.

Trade finance is a fast-growing market. 80 to 90% of world trade relies on trade finance, which is currently worth $9.7 trillion, with a CAGR of 3.1%.

Trade finance distribution is the most effective way to monetize this multi-trillion-dollar market.

One growth area is supply trade finance. SCF grew at a CAGR of 26% from 2017 to 2023 despite an increase in global protectionism and tariffs.

SCF continues to grow at a rate of “7% annually, currently worth $2.34 trillion, with funds in use at $916 billion,” according to the latest BCR Publishing’s World Supply Chain Report 2024. (2023 figures).

There are numerous opportunity gaps within this market. These exist wherever there are shortfalls in the trade finance market. For example, Asia, the Middle East, and Africa (MENA) are opportunity-rich markets.

One consequence of tariffs is trade diversification. Imports to the U.S. are likely to drop, but that means that manufacturers and exporters will be looking for new markets for their products.

In turn, this creates opportunities for trade finance and trade finance distribution. Now is the time to look at your presence in Asia, particularly South East Asia, and MENA.

The following countries and regions are largely untapped markets for trade finance: Africa, Asia, China, India, and the United Arab Emirates (UAE), worth $2.5 trillion, according to the International Asian Development Bank.

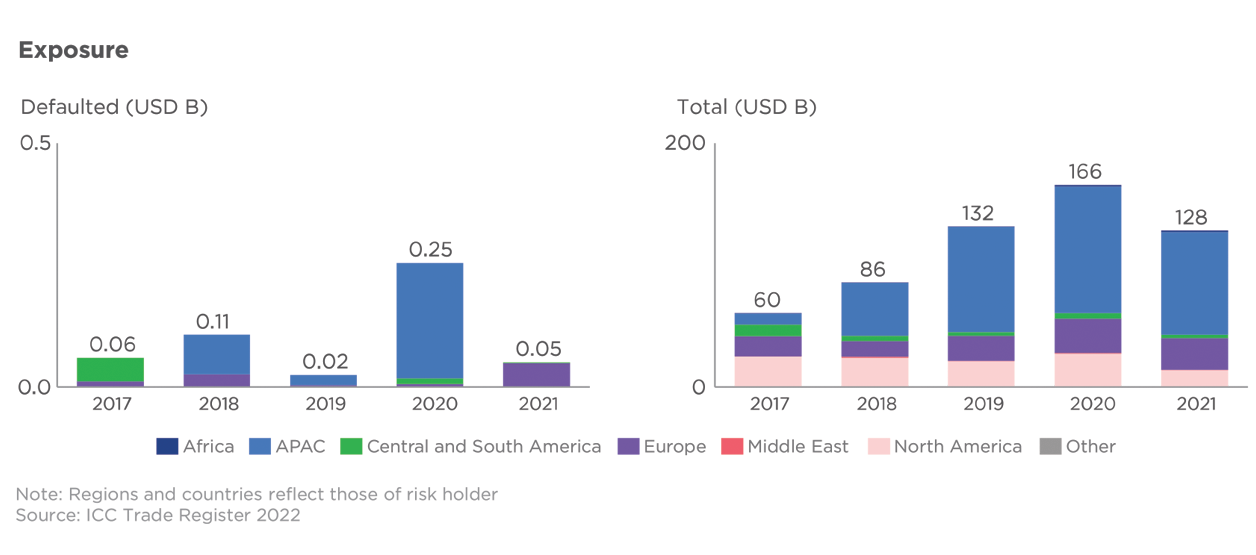

More good news: when it comes to trade finance distribution, the low-risk nature of these financial instruments makes them a more attractive opportunity in turbulent times. In most cases, default rates are under 0.25%. *

Table 1: The default rates of trade finance distribution have always been low

Low-risk and very low default rates for the following popular trade finance distribution financial instruments: accounts receivable (AR) and supply chain finance (SCF) (source)

How Was Distribution Managed Before Software Solutions?

Before there was distribution software, multiple parties involved in trade finance and trade finance distribution had to manage this in the following ways:

- Emails

- Faxes

- Phone calls

- Letters

- Spreadsheets

- Physical and computer-based files

As you can imagine, or are perhaps still dealing with yourself, information and important files could easily be overlooked, go missing, or get forgotten about.

Because we are talking about documents containing millions or more worth of value, emails and spreadsheets are an imperfect solution to say the least.

So, one way or another, banks and software companies have attempted to develop trade finance distribution software.

However, most software only does part of the work.

LiquidX is the first complete end-to-end solution, one so comprehensive that we can manage every aspect of trade finance, including distribution, without the need to increase headcount.

One of the challenges of trade finance distribution is managing the flow of information and documentation.

However, you can solve this with LiquidX’s tool for managing multiple sources of data that is platform-agnostic. This makes getting into distribution a lot easier.

Now, alongside our Middle- and Back-Office solution, let’s take a closer look at what our Distribution Software can do.

LiquidX’s Trade Finance Distribution Solution in Detail

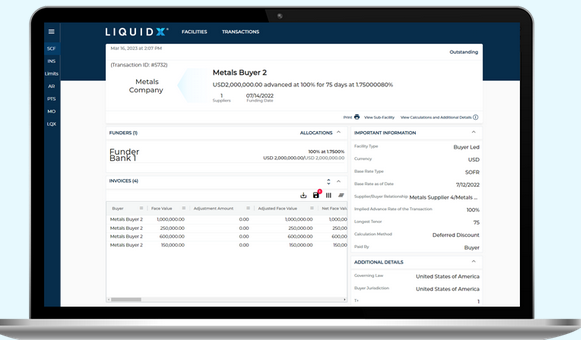

Our Trade finance solution ensures that platform administrators can configure and enable automated workflows to allocate payables or receivables finance transactions to a single funder (typically the platform administrator), or to multiple funders either within an Asset Manager or for a syndication/participation deal.

These distribution capabilities mean that a platform administrator can price individual funders and obligors at customizable rates to align with the deal structure.

LiquidX’s Trade finance solution provides flexibility for platform administrators to offer the technology to their corporate clients for invoice ingestion, offer acceptance, and status tracking.

Or if preferred, a platform administrator can limit the technology to internal parties to ensure offered assets are within the eligibility criteria.

We have recently made the following upgrades to our Distribution solution:

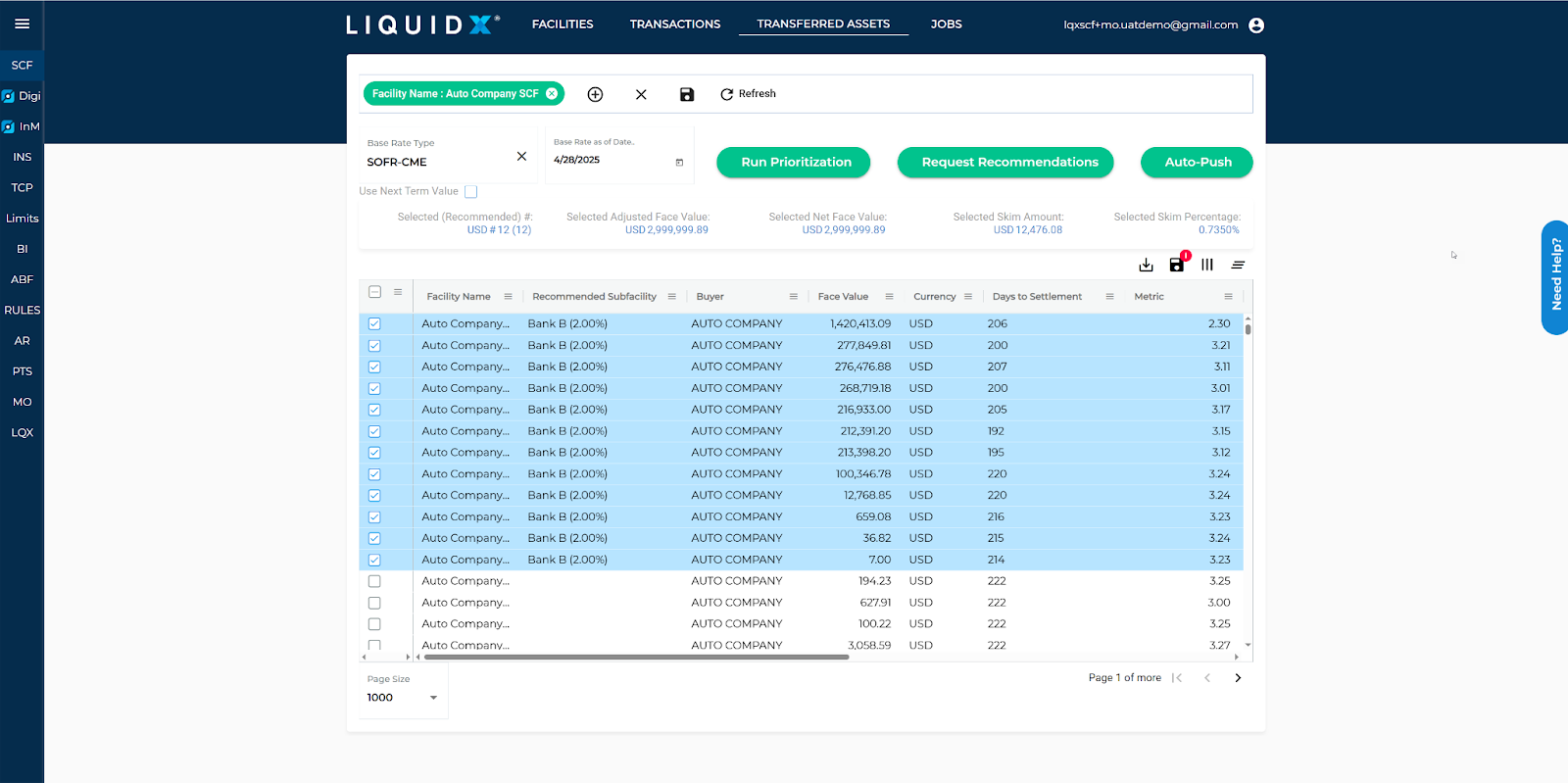

Now, banks and asset managers can more easily identify the assets already funded in their portfolio that have the greatest opportunity to be sold to the secondary market for a quick percentage-based profit (known as a skim). This is a prioritized list of assets as shown in the image below.

The assets with the greatest quick ROI sale value opportunity are based on market movement such as the change in rates over time and a change in the remaining tenor of the assets to generate an interest rate arbitrage.

You can now further filter the target pool of assets according to currency, obligors, and the criteria that the bank is targeting to offload assets, to narrow down on the available assets for distribution.

Once the best opportunity is identified, then potential sales targets are identified based on the banks or asset managers in your network. For example, based on the availability of established credit limits, the platform will optimize the skim revenue while accounting for the existing limit utilization to recommend a target investor for a specific pool of trade finance distribution assets.

These upgrades make it even easier for trade finance distribution participants to sell specific assets or bundles of assets at a skim to individuals or groups of investors.

Mona Ghazzaoui, Head Receivable and Payable Financing Americas at Crédit Agricole CIB, has this to say about the LiquidX solution:

“LiquidX has diligently developed a compelling solution to support the business requirements and provide an end-to-end solution from the sale of the receivables by the seller to the distribution to the participant banks, including eligibility checks, calculation, notification, and reporting to all applicable parties, including participant banks.”

“LiquidX’s trade finance distribution solution has allowed CACIB to automate many manual tasks performed by its middle office and to eliminate operational risk and improve the quality of service provided to the seller, including full visibility in real time to activities and data.”

Trade finance distribution is a high-growth opportunity for banks, asset managers, institutional investors, non-bank lenders, and alternative credit funds.

Here’s another great reason to work with us! In December 2024, Global Business & Finance Magazine awarded LiquidX with three awards for the second year in a row:

- Best Digital Solutions For Global Trade, United States 2025

- Best Technology Vendor Of The Year, United States 2025

- Best Fintech For Trade, United States 2025

Banks and asset managers: To request a demo of our trade finance distribution solutions, click here.

* Naturally, as with every financial product, there are risk factors. No investment is ever zero risk, and past performance of any asset class doesn’t always mean that future results will be the same. Please assess your organization’s risk appetite before making any new investment decisions. This article does not constitute investment advice in any way.