Menu

Close

Close

Menu

Monitor with

The first complete, platform-agnostic, real-time, front- and middle- office digital solution for all your positions and transactions.

Aggregate positions from various banks and platforms in a real-time dashboard.

Our TradeHub allows customers to aggregate their data across various investment programs and platforms, regardless of the origination source.

Create holistic views of your exposures relative to your unique risk constraints. The automation of reconciliation processes allows our engine to digitally match invoices, remittance advice, and payments.

TradeHub is fully configurable to your requirements with bespoke cross sections for your business. Data is accessible to stakeholders across the bank in order to make real-time, data driven decisions.

You can set up customized feeds and reports for unprecedented insights into insured and uninsured portfolios.

Huntington Bank needed to automate back office constraints that came with managing program participation from multiple banks

The LiquidX platform digitized all reports to standardize detail, customizable reporting and automated invoice reconciliation. This removed back office constraints to significantly increase the number of programs originated and participated.

LiquidX, the pioneer in the digitization of credit insurance, offers the only integrated Insurtech platform serving the entire credit insurance ecosystem.

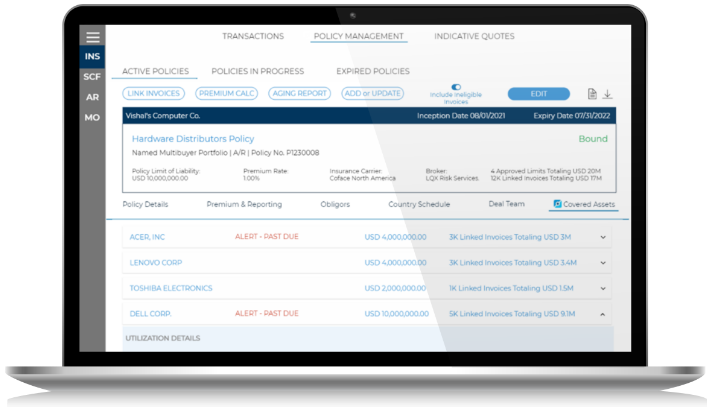

InBlock Digital Policy Management leverages smart contract technology, AI, and machine learning allowing market participants to reduce risk, reduce costs, while increasing efficiency, transparency, and scale through automation.

If you are a broker, carrier, asset manager, bank, or corporate, we have the solution for you.

Turn your policies from a static lifeless stack of paper into a dynamic, real time risk management tool.

InBlock Digital Policy Management offers unparalleled insight and transparency with the tools necessary to manage your insured portfolio in one centralized platform.

Increase client stickiness by discontinuing the use of third party systems and direct your clients to your own secure branded portal.

Provide your clients real-time access to policy information while automating policy management and compliance requirements.

Direct all client traffic into a single-stop branded environment where users can make new requests, manage ongoing deals, and view completed transactions.

© 2023 LIQUIDX. All rights reserved.